Growth Asia Summit 2024

HMOs, postbiotics, snackification spell big opportunities for China’s infant and maternal nutrition sector

In a survey co-published by Chinese e-commerce platform JD.com, MY Guancha (母婴行业观察) and its Maternal and Baby Research Institute, the market size of infant and maternal nutrition products was valued at RMB930m (USD127m) in 2023 and is projected to reach RMB1,010m (USD138m) this year.

“Due to the decreasing birth rate in China, the estimated growth rate of 8.6% for 2024 is nearly half of 2023’s (15.5%), but the increase in market size is still significant,” Doris Huang, senior food regulatory consultant at Hangzhou REACH Technology Group (CIRS), said during her presentation at Growth Asia Summit 2024.

According to the survey, folic acid supplement (59.3%) tops the list of nutrition products purchased by Chinese mothers, followed by maternal milk powder and maternal DHA. Vitamins and minerals, particularly calcium, iron and zinc, are also popular in the maternal nutrition category.

For infant nutrition, the best-selling categories are vitamins and minerals (22.5%), lutein (18%) and probiotics (16.8%). In addition, lactase products are increasingly sought after thanks to the rising awareness of lactose intolerance.

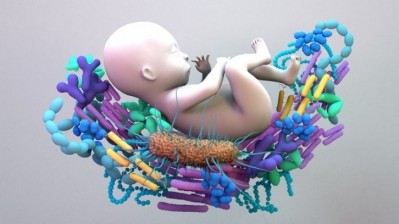

Notably, there are a few emerging ingredients that have opened new opportunities in this sector. One of them is HMOs, a variety of nutrients naturally present in breast milk.

Currently, there are over 200 known structures of HMOs, with six of them being extensively studied worldwide for their safety and function.

In China, four types of HMOs — 2’-fucosyllactose (2’-FL), lacto-N-neotetraose (LNnT), 6’-sialyllactose sodium salt (6’-SL), 3’-sialyllactose sodium salt (3’-SL) — are gaining attention.

Specifically, three companies, namely IFF, dsm-firmenich and Mengniu, have received approvals for their 2’-FL while dsm-firmenich received an additional approval for its LNnT.

“6’-SL and 3’-SL are not officially approved yet, but the Chinese authority has already published the draft approval for public comments. If everything goes well, they will be approved soon. After the first round of 2’-FL approval, more applications related to HMOs have been submitted. Up to May 2024, the number of applications for 2’-FL is highest at 18.

“As the production of HMOs usually involves genetically modified microorganisms, it requires an additional step from the regulatory aspect, compared to other new ingredients. This means that if a company want to get their HMO ingredient approved, they need to first obtain approval for their genetically modified microorganisms.”

Huang added that CIRS has been actively assisting its clients with the HMO application process.

Postbiotics potential

Another ingredient with potential for growth is postbiotics, said Huang.

“The inclusion of postbiotics in infant products in China is subject to approval by regulatory bodies, such as China National Health Commission (NHC) and State Administration for Market Regulation (SAMR), to ensure that any health claims made by manufacturers are backed by scientific evidence and that the products are safe for infant consumption.”

Currently, there is no postbiotic approved in the country. One of the challenges in the approval and broader adoption of postbiotics is the need for more extensive clinical trials and research to firmly establish their health benefits and safety, especially for infants.

“Going forward, there is still significant potential for innovation. Continued R&D is expected to expand the range of available postbiotic compounds and their applications in pediatric nutrition. We look forward to seeing more postbiotics, such as carrot-derived components, in the formulation of infant products.”

Snackification and segmentation

Five areas of product innovation that consumers care about have been observed. These are no usage of food additives, personalised nutrition, good taste, continuous strengthening of nutritional functions, and snacking.

In particular, maternal and infant health products are said to be rapidly transitioning towards snackification.

“More and more companies are making efforts to make their products look like snacks. The snackification trend is driving multidimensional innovation in the nutrition industry, most directly reflected in the development and improvement of product formats and flavours.

“For instance, gummies are a common snack and by incorporating nutrients into them, they are upgraded to functional snacks, which may better meet current consumption demands. Additionally, snackified nutrition products are more appealing and can be easily taken compared to traditional health foods that may require dissolving or boiling, or dietary supplements in hard-to-swallow capsule format.”

Functional snacks may also allow consumers, especially infants and children, to consume nutrients on a more regular basis.

As for concerns related to snacking, such as childhood diabetes and dental problems, one of Huang’s recommendations is for companies to use sugar alternatives.

“Some companies may think jellies are an attractive format, but jellies are not suitable for infants to consume. So, when a company is designing a novel product or format, different aspects need to be considered.

“For example, the nutritional requirements for infants aged 0 to 6 months differ from those aged 6 to 12 months. Similarly, there is a growing trend of stage-specific customisation in maternal nutrition products, such as various kinds of folic acid supplements tailored for different stages of pregnancy.”